The Cost Of A Vote

I have talked much and written thoughtfully about what is often called the insidious[i]In actual fact, it is not insidious at all. You can see it coming from a mile away – caused 100% by irresponsible government overspending. tax called “Inflation”. It is misunderstood by most people, and routinely misused by political pundits to mislead the people who suffer from it. Unfortunately, while it applies to us all, the only ones who don’t care are the independently wealthy. They just tell their accountants to write bigger checks, while the middle class cancels their vacation plans, and the people living from paycheck to paycheck get evicted.

I will bite my tongue to avoid the obvious political connection, but when you go to the polls in November, remember the following.

![]()

The Consumer Price Index has increased over the past three years by a cumulative total of 37%. In other words, that pair of Blue Swede Shoes that would have cost you $100 in 2023, will now cost you $137. You have already felt the effect of the problem from your last visit to Burger King.

The Consumer Price Index has increased over the past three years by a cumulative total of 37%. In other words, that pair of Blue Swede Shoes that would have cost you $100 in 2023, will now cost you $137. You have already felt the effect of the problem from your last visit to Burger King.

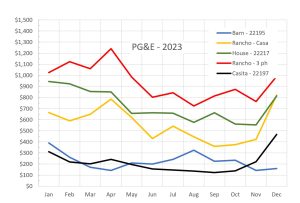

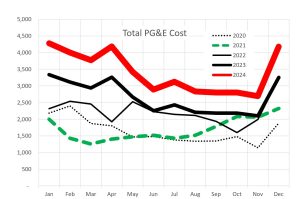

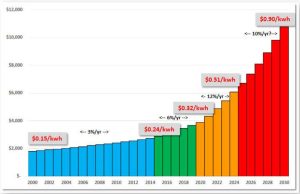

We know that the vast majority of the increase comes directly – or indirectly – from the energy sector of the economy (vehicle fuel, heating oil, electricity, etc.), causing everything else to go up with it. PG&E rates have gone up almost 30% over the past few years, and are already programmed to go up an additional 28.4% during 2024 alone. As a direct result of misguided energy policy, the price of energy will continue to increase well into 2025 and beyond. We also know of course, that the trucks and trains and airplanes that deliver the stuff to the nearby restaurants and stores need that energy, so we understand why that Wopper and fries costs double what it used to. So it should be no surprise when rents go up.

In addition, while property tax increases in California are limited to 2% per year, thanks to the ever-popular Howard Jarvis initiative of 1978, government policy is driving virtually every fire insurance underwriter out of the market. The only choice left in rural California is the FAIR plan, at the rate of 3.5 times the previous competitive rates.

But back to energy – the market sector that drives all the others. The PG&E numbers at Patchen are staggering, and there is no end in sight. Under the most optimistic assumption that the Federal Reserve gets the “Annualized Inflation Rate” back to 2% over the next year or two, the damage is already done, and the cumulative effect of all that government overspending is with us to stay – click the charts to see the gory details.

Hopefully, we are 2/3 of the way through what appears to be a 40% to 60% “Cumulative Inflation” problem, so it seems reasonable to mitigate the impact of that on rents over a similar timeframe.

Effective April 1, rent amounts at Patchen will go up by 20%, followed by a similar increase at the end of 2024. Beyond that point, it is impossible to know – voters have the last word.